how does hawaii tax capital gains

California taxes capital gains as ordinary income. Capital Gains and Losses.

Hawaii Income Tax Hi State Tax Calculator Community Tax

A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to 500000 if they 1 owned the home for at least 2 years and 2 lived in the home as a primary residence for at least 2 of the past 5 years.

. Schedule D is required to report these taxes. The capital gains rate will be 15 percent on income between 40401 and 445850 however. This is called the capital gains tax.

Short-term capital gains are taxed at the full income tax rates listed above. In Hawaii capital gains on real estate are subject to a 75 tax. Hawaii taxes capital gains at a lower rate than ordinary income.

2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. There is good news for Hawaii residents. And since gold is an investment asset when you sell your gold and make a profit it is taxed as capital gains.

The highest rate reaches 133. 745 Fort Street Suite 1614. For complete notes and annotations please see the source below.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017. You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year.

Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly. How does Hawaii rank. For taxable income in taxable year capital gains tax is charged at 00 15 20 or ccess tax rate is 0 15 or 20 depending on your taxable income for the year.

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. 12 hours agoInvestors holding investments for at least a year are subject to capital gains taxes for profits from sales of most securities. Each states tax code is a multifaceted system with many moving parts and Hawaii is no exception.

Since 2018 the rate is 75 up from 5. Hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 1035 exchanges provide a way to trade-in an annuity contract or life insurance policy without triggering a tax liability.

How Much Tax Do You Pay On Real Estate Capital Gains. Though depending on how you held your gold. Below we have highlighted a number of tax rates ranks and measures detailing Hawaiis income tax business tax sales tax and property tax systems.

Like the Federal Income Tax Hawaiis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. The Hawaii Department of Revenue is responsible for publishing the latest Hawaii State.

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. Hawaii Capital Gains Tax In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. The highest rate reaches 11.

The 10 states with the highest capital gains tax are as follows. Chris Rock once remarked You dont pay taxes they take taxes 1 That applies not only to income but also to capital gains. States With the Highest Capital Gains Tax Rates.

In both the short term and long run they apply. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii. An asset held for over a year is subject to long-term capital gains tax.

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. Capital gains are categorized as short-term gains a gain realized on an asset held one year or less or as. Hawaii Capital Gains Tax.

The first step towards understanding Hawaiis tax code is knowing the basics. Use this calculator to estimate your capital gains tax. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate.

In Hawaii capital gains tax is set at 7 percent. Hawaii Financial Advisors Inc. Capital gains result when an individual sells an investment for an amount greater than their purchase price.

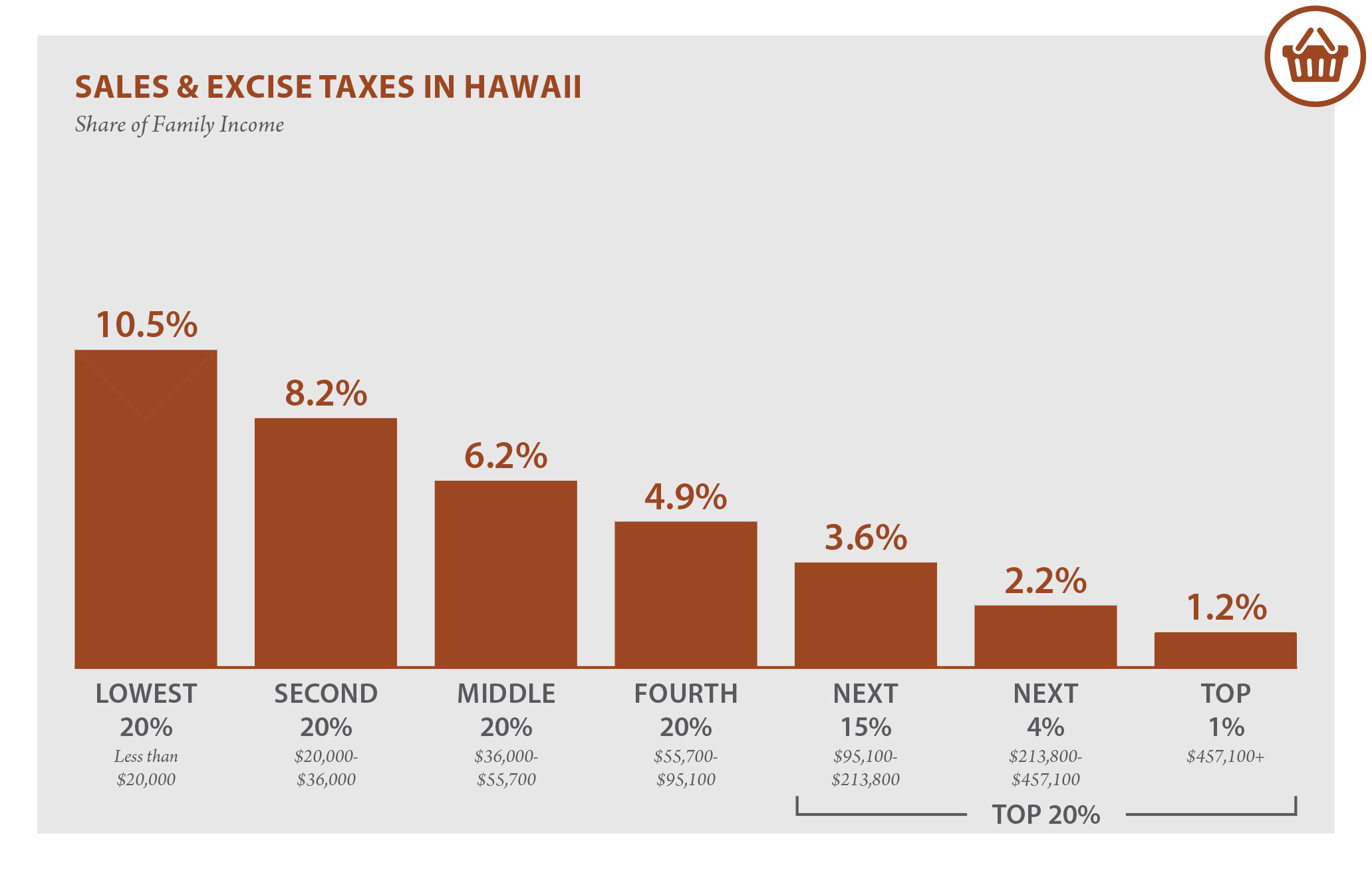

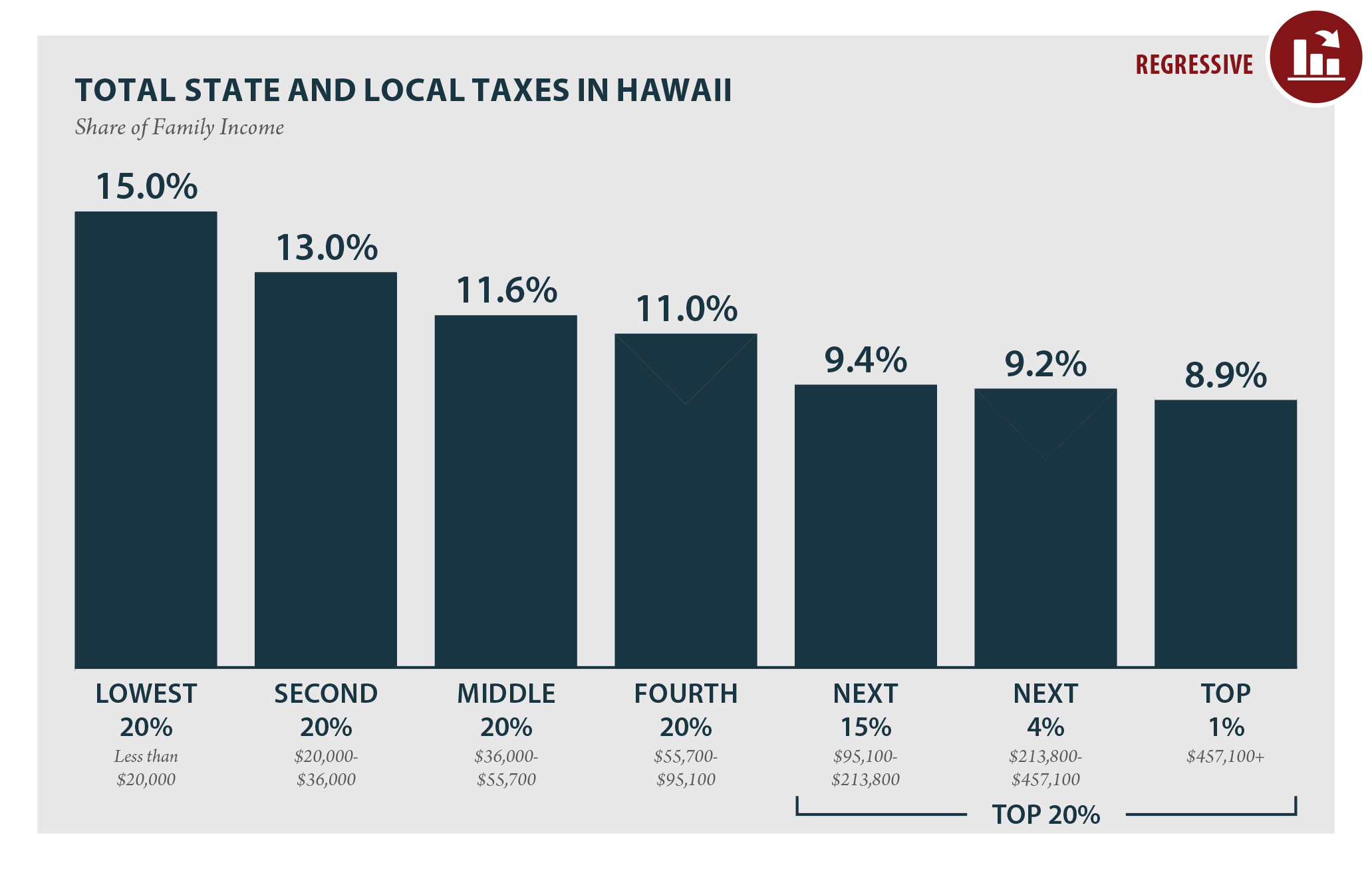

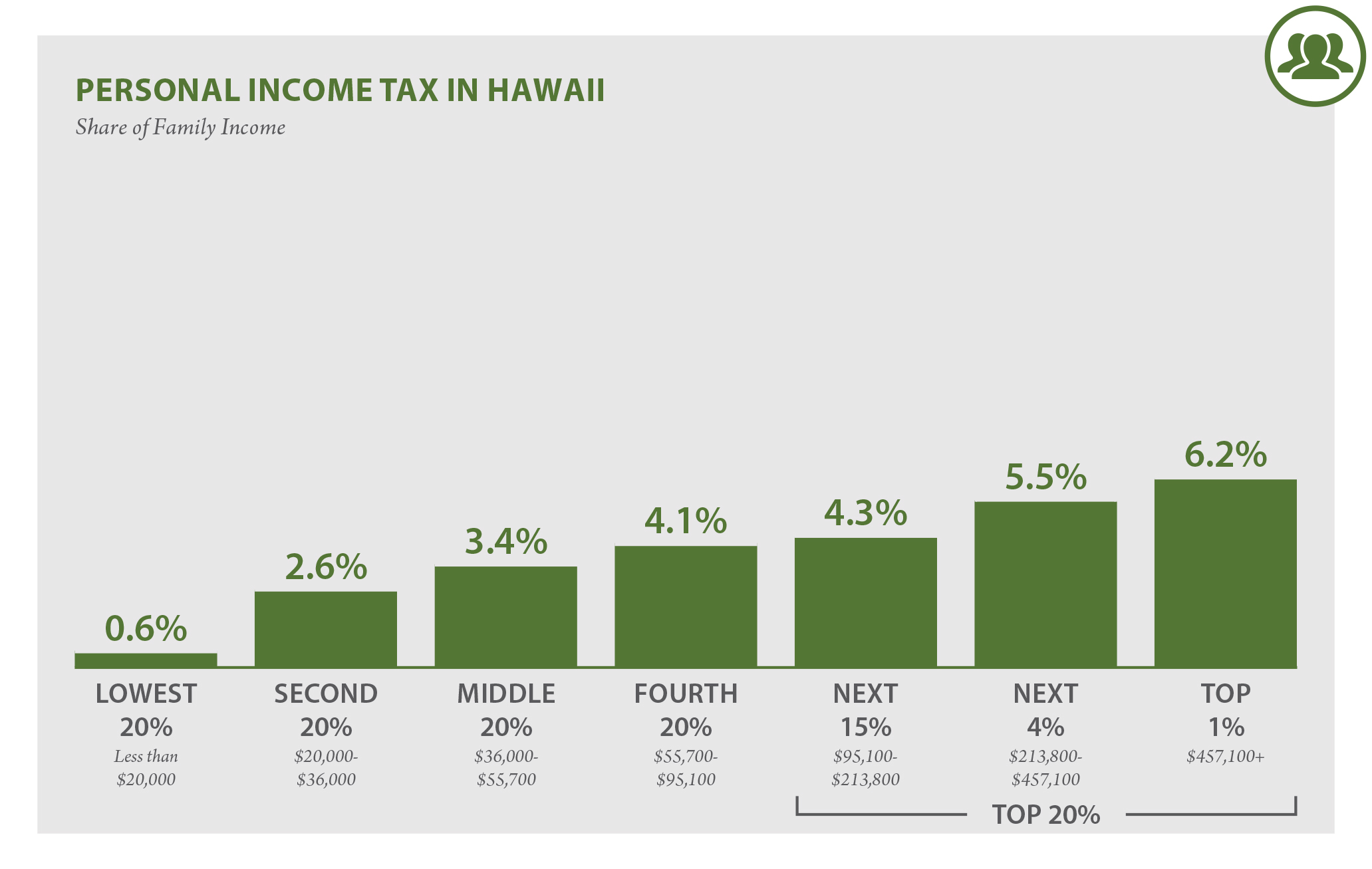

Hawaii Who Pays 6th Edition Itep

Hawaii Who Pays 6th Edition Itep

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

Hawaii Income Tax Calculator Smartasset

Hawaii Income Tax Hi State Tax Calculator Community Tax

Harpta Firpta Tax Withholdings Avoid The Pitfalls Hawaii Living Blog In 2021 Tax Refund Hawaii Real Estate Tax

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

Testimony Sb2485 Cites Tax Fairness In Proposing State Capital Gains Tax Increase Grassroot Institute Of Hawaii

Hawaii Who Pays 6th Edition Itep

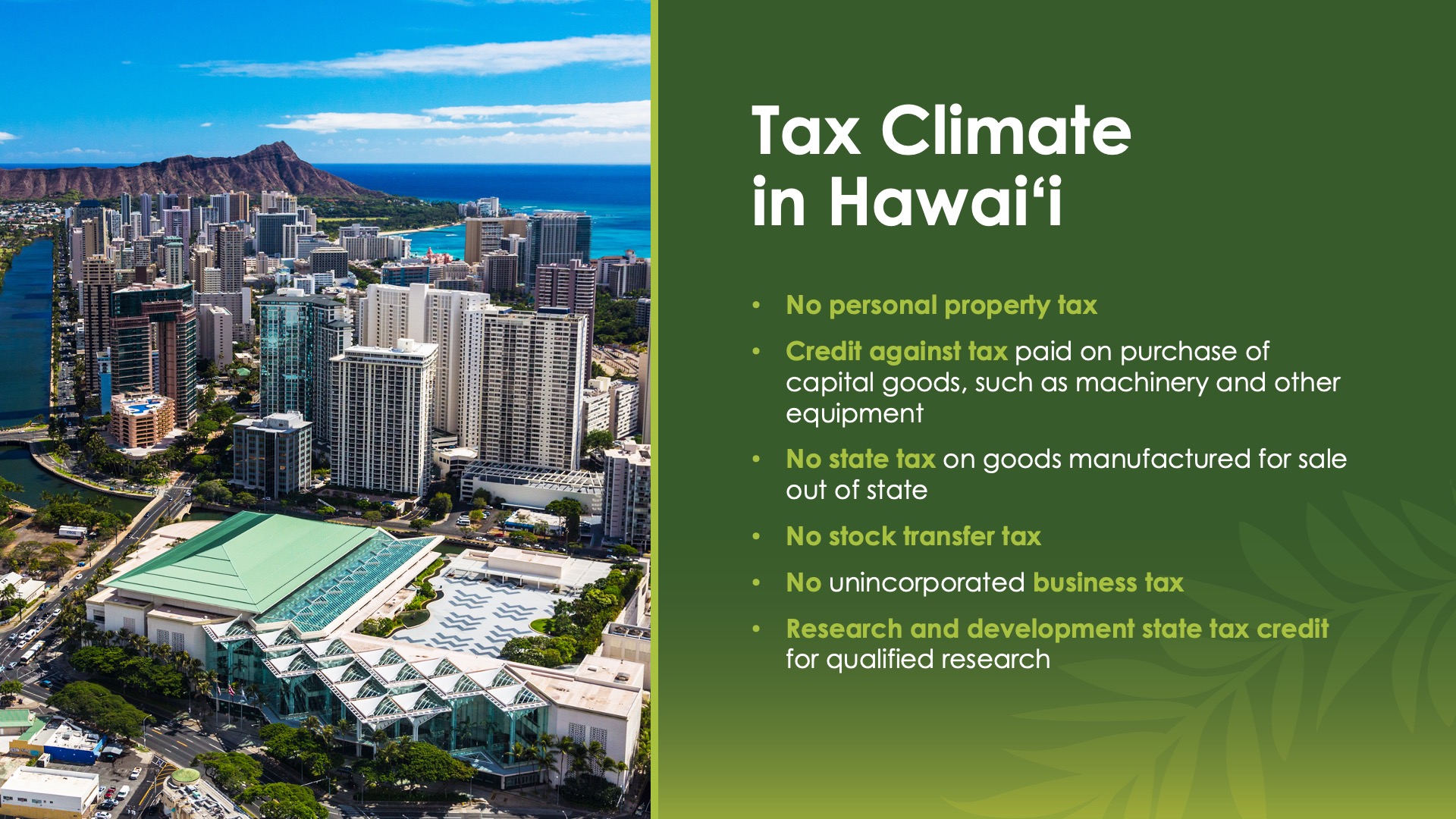

Business Development And Support Division Tax Incentives And Credits

Pin By The Agency Team Hawai I On Hawaii Real Estate In 2022 Hawaii Real Estate Big Island Estates

Biden Trickle Down Economics Has Never Worked Axios In 2021 Trickle Down Economics Economics Capital Gains Tax

Pin On Charts Graphs Comics Data

Historical Hawaii Tax Policy Information Ballotpedia

Hawaii Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

How High Are Capital Gains Taxes In Your State Tax Foundation

Harpta Maui Real Estate Real Estate Marketing Maui